Offices

Offices

Retail

Retail

Alternatives

Alternatives

Industrial

Industrial

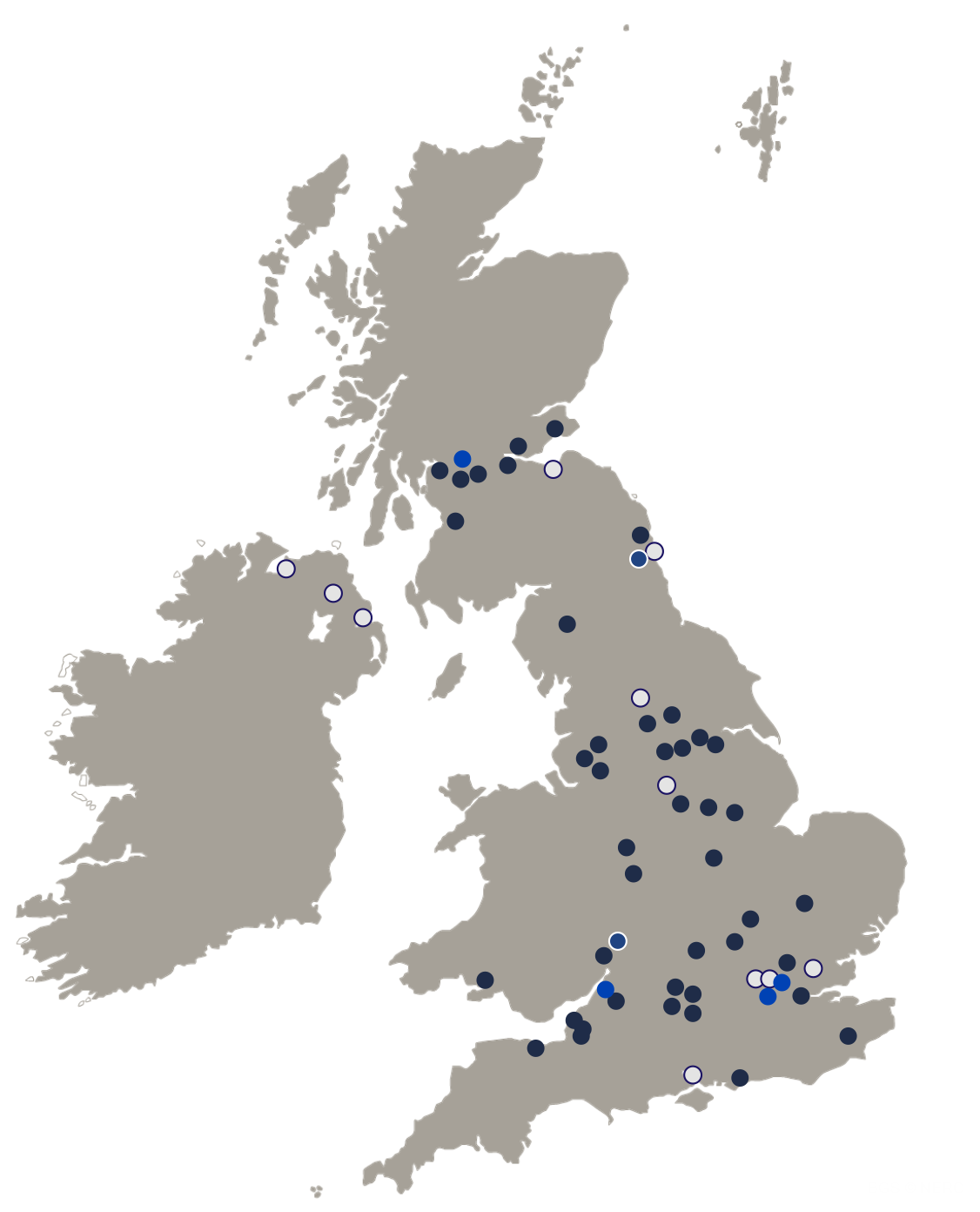

With extensive experience across all the main UK commercial real estate sectors we have an enviable track record of providing professional service and delivering outperformance.

Access and exposure to local markets across the UK.

Offices

Offices

Retail

Retail

Alternatives

Alternatives

Industrial

Industrial