We have been busy across the Cordatus Property Trust portfolio completing a number of ESG initiatives in 2020, but our work is never complete with a focus on ongoing projects for 2021. A couple of examples of the work completed last year are:

33 Bothwell Street, Glasgow

The 2nd floor vacant office suite was stripped back to shell condition and the gas-fired wet panel heating system was removed. The refurbishment works included the installation of a new ceiling system, with LED lighting and PIR motion sensors, plus a new 7 zone, 2 pipe VRF heating and cooling system. On completion of the works, the accommodation received an EPC rating B.

The reception area of the building was also upgraded. Works included the replacement of the reception desk and furniture, new flooring and wall coverings. Lights were replaced with new LED lighting.

Minster Court, Littlehampton

We took back an industrial unit totalling 3,200 sqft, which had been heavily fitted out as a food processing unit. We undertook strip out and refurbishment works, in order to bring the unit up to a lettable standard. The works included the removal of two cold storage units, a mezzanine structure, three industrial cookers and a thorough overhaul of the electrical system and services throughout.

The project presented an opportunity to review the unit’s ESG credentials and upgrade accordingly. We were able to replace the existing lighting with LEDs, plus the removal of an old inefficient boiler with a new electric flue boiler designed to heat re-circulated water within the heating system therefore recycling water and reducing waste.

2021 ESG Initiatives Underway

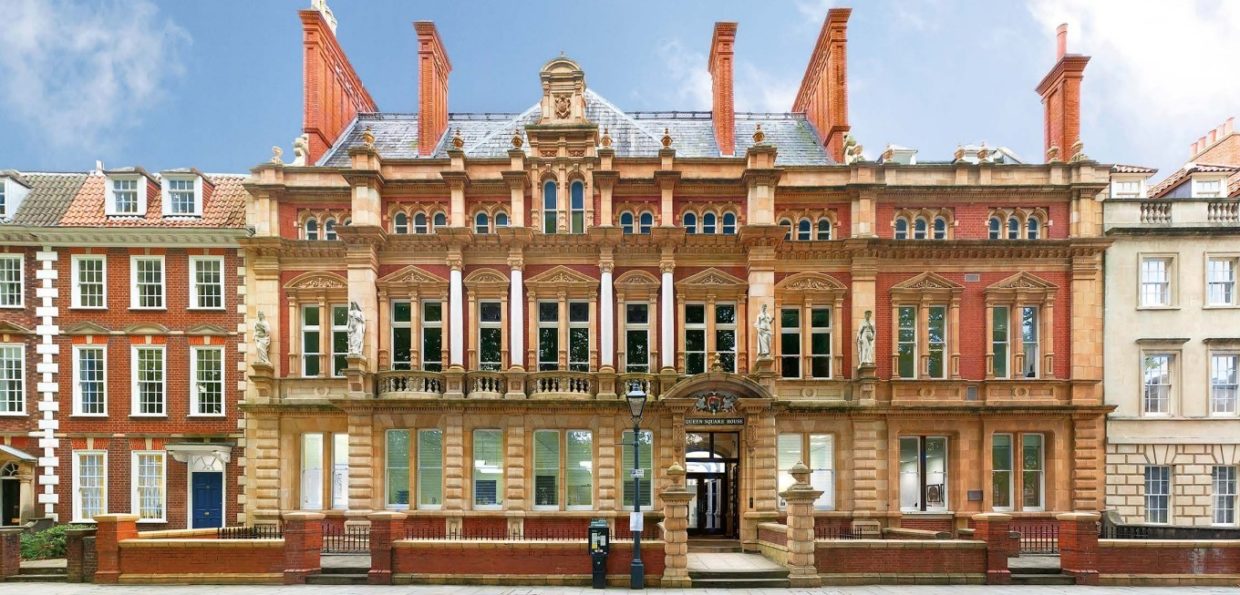

In 2020 we completed a BREEAM In-Use assessment of Queen Square House, Bristol. The assessment resulted in an Acceptable rating, will boost the fund’s GRESB score in 2021 and will be used to inform the ESG performance of the asset going forward. To assist with this a BREEAM In-Use Improvement Plan has been produced and will be reviewed to identify appropriate actions that can be implemented in the coming years.

We are also reviewing the energy performance of the whole portfolio. One element of this is updating and improving the EPC ratings on all units and taking a risk based approach to EPC improvement. A second element of our energy performance review is targeted energy audits at our assets with the highest energy consumption. The first asset we are targeting for an energy audit is the Lisnagelvin Shopping Centre in Londonderry. An initial desk-based assessment has been completed and an on-site audit will be undertaken once Covid restrictions are lifted.

Another key priority is to fully understand the Taskforce on Climate related Financial Disclosure (TCFD) recommendations and how they apply to the portfolio and assets so that the portfolio is resilient to climate related risks. As part of this we are considering different options for the assessment of physical and transition risks. This will include making use of the Carbon Risk Real Estate Monitor (CRREM) tool to assess the transition risks associated with assets for which we have data.